The demand for high-quality, durable materials in various industries has led to a significant increase in the use of prepreg technology, particularly in the production of UD fabrics. According to a recent report by MarketsandMarkets, the global market for composite materials is projected to grow from USD 24.24 billion in 2021 to USD 42.71 billion by 2026, with a rising emphasis on efficiency and quality driving this trend. As a key component in this production process, the "Prepreg Machine For UD Fabric" stands out for its unmatched precision and performance.

Chinese manufacturers have emerged as leaders in this sector, offering advanced solutions that cater to the specific needs of global supply chains. This blog explores the exceptional quality of Chinese-made prepreg machines, highlighting their role in ensuring the superior performance of UD fabrics, which are increasingly favored in aerospace, automotive, and construction industries due to their lightweight and strength characteristics.

The advancement of Chinese prepreg machines has been a game changer in the composite materials industry. With a projected market size of USD 0.35 billion by 2029, the demand for high-quality UD fabric has surged globally. Chinese manufacturers are setting new benchmarks for efficiency and innovation, allowing companies worldwide to benefit from superior production capabilities. This shift not only enhances the quality of composites but also reduces lead times, fulfilling the rising demand in industries such as aerospace, automotive, and renewable energy.

**Tips:** When selecting a prepreg machine, consider factors such as automation level, ease of maintenance, and the machine's adaptability to different resin systems. Investing in a machine that offers versatility can significantly enhance your production capabilities and responsiveness to market demands.

Moreover, the integration of advanced technologies into Chinese prepreg machines is redefining industry standards. Features like real-time monitoring and automated quality control systems ensure consistency in manufacturing processes. Businesses that leverage such advancements stand to gain competitive advantages in the increasingly saturated global market.

**Tips:** Always stay updated on the latest technological advancements in prepreg processing to keep your competitive edge. Continuous learning and adaptation will be key to thriving in this fast-evolving sector.

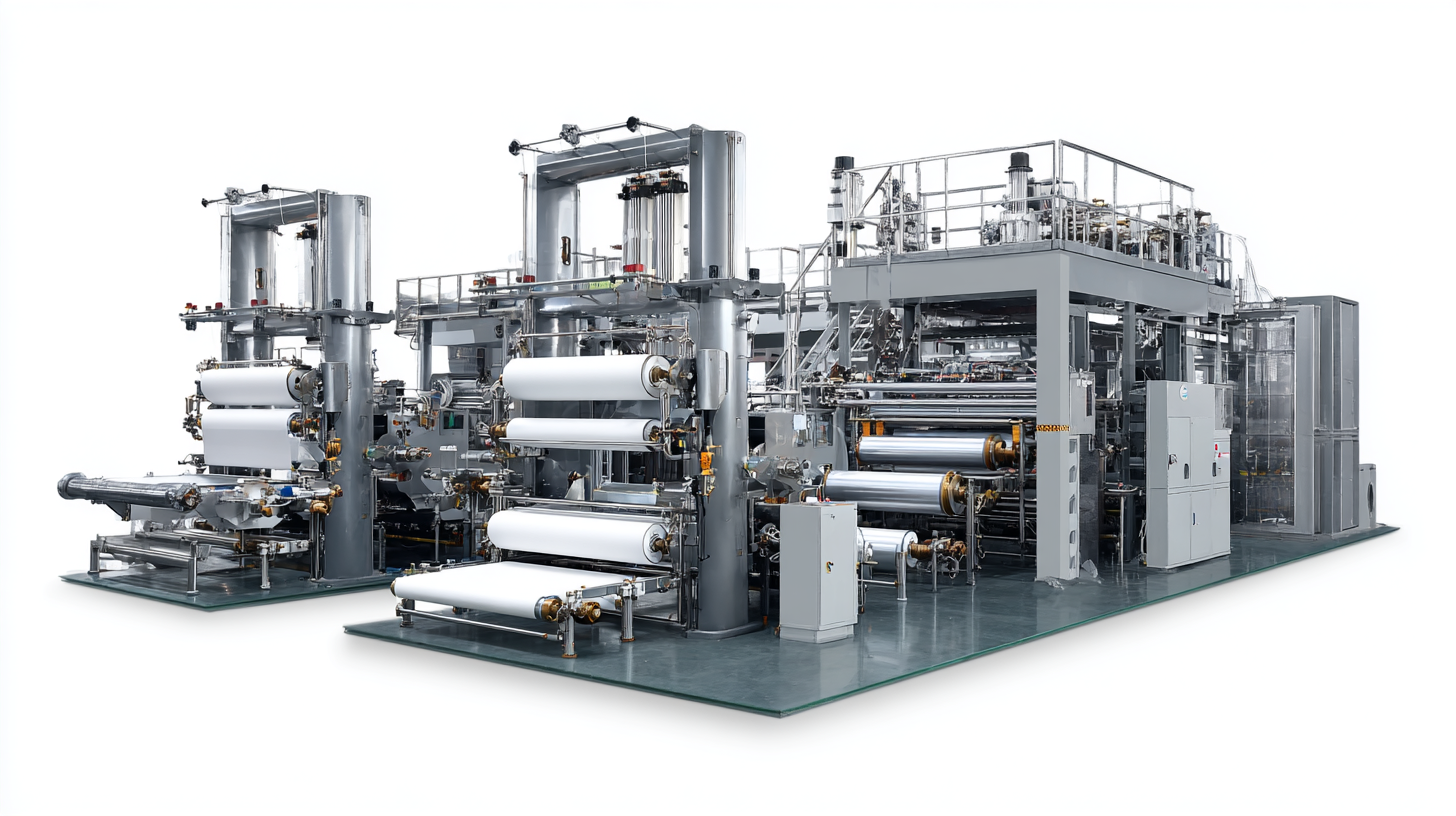

The advanced technology behind Chinese UD fabric production is revolutionizing the textile industry with unmatched quality and innovation. These prepreg machines, designed for optimal performance and efficiency, leverage cutting-edge processes that ensure high durability and reliability in fabric output. This technological prowess places China at the forefront of global UD fabric supply, catering to diverse industries, including automotive, aerospace, and sports.

Tips for manufacturers looking to enhance their production capacities include investing in updated machinery that supports sustainable practices. This not only aligns with the growing demand for eco-friendly products but also improves operational efficiency. Furthermore, collaborating with technology leaders in the field can provide insights into best practices and innovative processes that can be integrated into existing manufacturing setups.

Additionally, staying informed about global trends in material science, such as advancements in recycling technologies, can significantly impact the quality and sustainability of UD fabrics. By embracing these innovations, companies can position themselves to meet the evolving market demands and maintain a competitive edge in the industry.

The cost-effectiveness of Chinese-made prepreg machines has become a significant focus for international markets. As the global tow prepreg market is expected to skyrocket from USD 3.20 billion in 2024 to reach an impressive USD 7.02 billion by 2033, the demand for high-quality production equipment has never been more pressing. Chinese manufacturers are at the forefront, providing advanced prepreg machines that offer unmatched quality at competitive prices. This aligns with the projected growth in the composite textile production equipment market, which is anticipated to rise from USD 6.8 billion in 2024 to USD 7.2 billion in 2025, further illustrating the potential for cost savings and efficiency these machines can deliver.

Moreover, the shift towards in-house prepregging is influencing procurement decisions within the industry. By investing in Chinese prepreg machines, companies can significantly reduce their operational costs while maintaining quality standards. It can be estimated that the entry into the in-house production arena may allow users to capitalize on a cost/benefit analysis that favors long-term investments in reliable, high-performance equipment. As businesses aim to adapt to market demands and optimize manufacturing processes, the importance of cost-efficient solutions provided by Chinese prepreg technology will undoubtedly remain a focal point.

When it comes to the manufacture of prepreg materials, Chinese factories have consistently demonstrated a remarkable ability to produce high-quality products that meet the rigorous standards of the global market. According to a recent report by Research and Markets, the global composite prepreg market is expected to reach $9.5 billion by 2025, with a significant portion driven by Chinese manufacturers, who excel in advanced technologies and cost-effective production methods.

These factories have invested heavily in automated processes and stringent quality control measures, ensuring that each batch of prepreg meets the specified thermal and mechanical properties required across industries.

Chinese manufacturers’ commitment to quality assurance is reflected in their adherence to international standards such as ISO 9001 and IATF 16949. These certifications not only validate their operational efficiencies but also enhance customer trust. A survey conducted by the China National Chemical Corporation reported that manufacturers are continuously improving their production techniques and raw material sourcing, emphasizing the use of high-grade resin systems such as epoxy and polyester.

This focus on quality has positioned Chinese prepreg suppliers as leaders in the market, capable of satisfying the growing demand for lightweight and high-strength materials across sectors like aerospace, automotive, and winds energy.

The global impact of Chinese exports on the UD fabric industry is profound, as evidenced by recent data. In 2022, China accounted for approximately 40% of the total global exports of UD fabrics, reflecting its dominant position in this market. According to a report by ResearchAndMarkets, the global UD fabric market is projected to grow from USD 1.23 billion in 2021 to USD 2.15 billion by 2026, fueled largely by the exceptional quality and cost-effectiveness of Chinese-made prepreg machines. These machines play a crucial role in manufacturing UD fabrics, offering precision and consistency that are unmatched by competitors.

In addition, the advancements in technology within Chinese manufacturing have significantly contributed to the industry's evolution. The integration of automation and high-tech manufacturing processes has enabled Chinese producers to deliver superior prepreg quality. For instance, the International Composites Market Report highlights that the efficiency of Chinese prepreg machines has increased production yields by up to 30%, making them a preferred choice among global manufacturers. As the need for lightweight yet durable materials rises in sectors like aerospace and automotive, China's influence on UD fabric supply chains is set to continue growing, shaping the future of the industry.